CAVA Stock Price: Price Performance and Q2 Earnings

Cava stock news for today highlights a nearly 6% increase in shares, following a reported profit of 17 cents per share.

CAVA Group, Inc. (NYSE: CAVA), a rapidly emerging player in the restaurant industry, has captivated both food enthusiasts and investors alike. Founded in 2006 and headquartered in Washington, DC, CAVA is renowned for its vibrant chain of Mediterranean-inspired restaurants across the US. The company has expanded its customer base by offering its popular dips, spreads, and dressings in supermarkets and providing convenient online and mobile ordering options.

This year, CAVA has emerged as a likely big winner. It climbed more than 128% and outpacing industry giants like Chipotle and Starbucks. It has also stood out against the Invesco Food & Beverage ETF (PBJ), which has remained relatively flat. Supported by strong market performance and growing brand popularity, CAVA has gradually become a formidable contender on Wall Street.

CAVA Stock History

CAVA Group stock has shown significant growth as the brand’s market share continues to rise with increasing popularity. Over the past few years, CAVA’s turnover soared from $500 million in 2021 to over $728 million in 2023. Additionally, the company transitioned from a yearly loss of nearly $37.4 million to a profit of $29.9 million in the last twelve months.

This success has been driven by the growing demand for Mediterranean cuisine nationwide and the expansion of CAVA’s store network. In the most recent financial results, CAVA reported a 30.3% increase in revenue for the first quarter, reaching over $256 million. Same-store sales grew by 2.3%, which was lower than Chipotle’s 7% growth.

CAVA’s revenue has been bolstered by both its digital and retail channels, with 37% of its business coming from digital platforms like DoorDash and Uber Eats.

CAVA Group Faces Valuation Woes

Investor scepticism towards CAVA Group is widespread, with the company’s valuation being a primary concern. With a market cap of $11 billion, some investors and analysts question whether the stock is overvalued.

In June, JPMorgan analysts downgraded the stock to $77, 22% lower than its current price. According to their note, CAVA Group has a solid financial foundation, with an average unit volume of $2.6 million and a cost of $1.5 million per location. However, its valuation remains a point of contention. This has led to concerns that its current financial metrics may not justify the company’s stock price.

Valuation is a significant concern as the company trades at a forward EV-to-sales multiple of 12, nearly ten times higher than the restaurant industry average of 1.22. The forward price-to-sales multiple of 12.65 is also elevated compared to the sector, with a median of just 0.88.

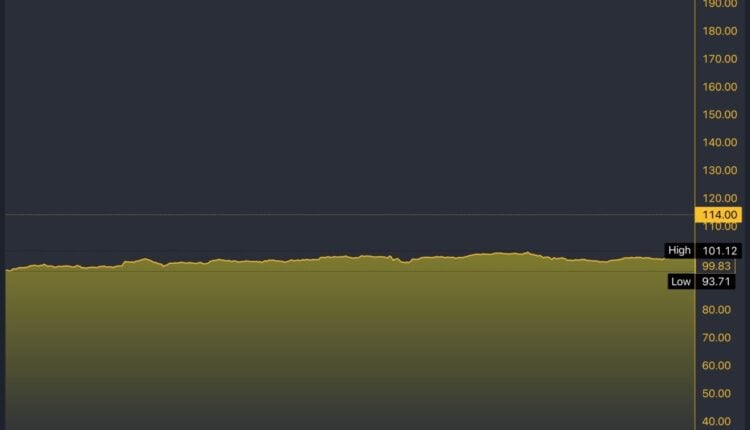

From a technical perspective, the stock has recently formed a double-top pattern around the $100 level, suggesting a potential decline following the next CAVA Stock earnings disclosure. Key support and resistance levels to watch are $95 and $105, respectively.

CAVA/USD 5-Day Chart

CAVA Group to Post Q2 Earnings

CAVA Group, Inc. will release CAVA’s second quarter of 2024 financial numbers in August after the market closes.

In the most recent quarter, CAVA’s earnings exceeded the Zacks Consensus Forecast by an impressive 200%. Over the last four quarters, CAVA has consistently outperformed expectations. It had an average earnings surprise of 450%, making it one of the best-performing companies during this period.

The Zacks Consensus Estimate for CAVA Group’s restaurant sales is $218.4M. This is an increase of 25.7% year over year in sales. Compared to the same period last year, the consensus estimate for 2022 sales in CAVA comes in at a growth rate of 7.2% year over year.

Price Performance & Valuation: Cava Stock Price Prediction

Cava Group has stood out in the stock market this year. It defied industry trends and outshined major benchmarks like the S&P 500. CAVA’s stock has surged by an impressive 133.1% year-to-date. In contrast, the broader restaurant sector has declined by 2.4%. Meanwhile, industry giants like Darden Restaurants, McDonald’s, and Restaurant Brands International have all experienced notable drops in their share prices. However, some are still cautious about CAVA’s valuation because it has been rather demanding.

The CAVA stock forecast for 2025 is currently $101.06. CAVA Group, Inc. shares will continue rising at the average yearly rate as they did in the last 10 years. It represents a 4.34% increase in the CAVA stock price.

The company’s 12-month forward price-to-sales ratio is 11.18. It is a substantial margin higher than the industry’s average of 3.79, with the S&P 500’s equivalent being 5.28. Thus, the high P/S ratio hints at the fact that the investors are paying a hefty price for CAVA’s growth potential, which makes it a stock to be very careful of in the months ahead.

Investment Thoughts

For existing shareholders, the stock quote of CAVA suggests a good purchase considering the company’s market positioning, growth strategies, and performance record.

CAVA has recognised its ability to drive innovation and have superior customer service experiences, which may help it grow. Meanwhile, new investors might heed caution due to the current inflated valuation and potential cost pressures that could reduce short-term profits.

Waiting for a market downturn or a drop in share prices can give you the perfect opportunity to buy CAVA shares at a better value. Balancing optimism with caution is key to maximizing earnings in today’s ever-changing markets.

The post CAVA Stock Price: News and Price Forecast 2025 appeared first on FinanceBrokerage.